In traditional New Jersey GOP district, Republican tax bill is giving voters second thoughts

Will the GOP's tax bill hurt or help in an affluent New Jersey district?

WAYNE, N.J. -- This northern New Jersey congressional district is more deeply divided politically than it's been in two decades, but there's one thing most everyone agrees on: the tax burden is way too high.

New Jersey not only has the highest property taxes in the nation, but the four counties that make up the 11th Congressional District have the highest state taxes as well. And although the district has leaned Republican for more than 20 years, the tax bill President Donald Trump and congressional Republicans pushed through last December -- aimed at helping GOP candidates in the midterm elections -- might not drive Republican voters to the polls after all.

In fact, it might do just the opposite.

According to a recent poll by Monmouth University, voters in this affluent district aren’t exactly happy about the GOP tax measure: 43 percent approve and 46 percent disapprove and almost a third of voters significantly disapprove. Only about 1 in 4 voters strongly approve.

The part of the tax bill that rocked the Republican-leaning status quo in this suburban district is the much lower limit on state and local tax deductions, or SALT cap: It's set at $10,000.

More than 41 percent of New Jersey residents rely on SALT deductions to offset high local and state taxes, one of the highest percentages in the country. Other states, like New York and California, are also seeing pushback over residents who rely on the cap to decrease their overall tax bills.

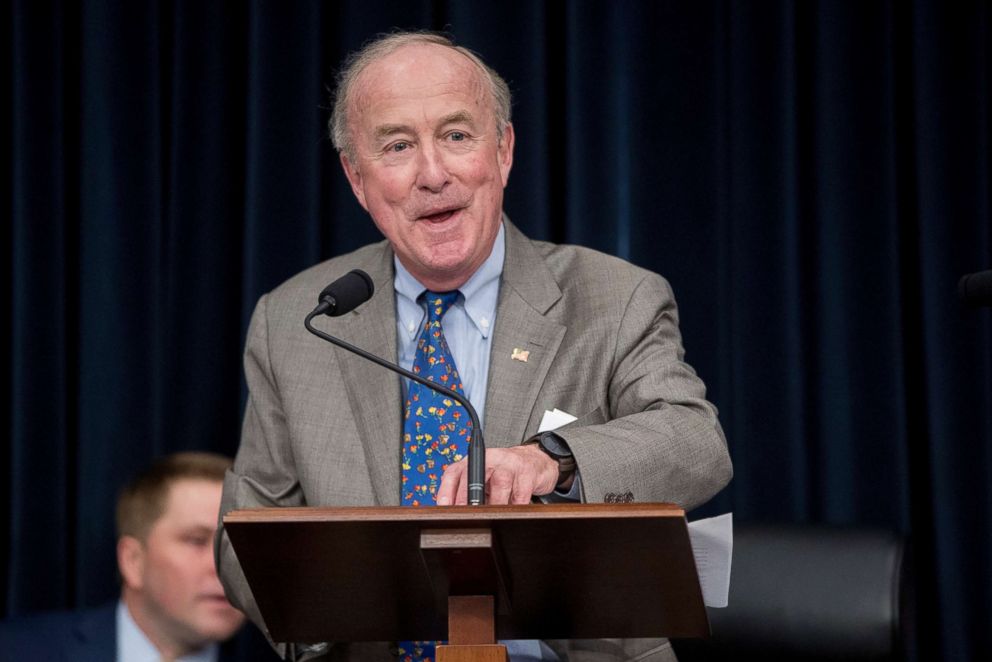

The SALT cap is causing political reverberations here. It was the reason Republican Rep. Rodney Frelinghuysen, the longtime chairman of the House Appropriations Committee, went against president and party and voted against the bill. Now, Frelinghuysen is retiring -- and New Jersey’s 11th is an open seat race for the first time since he was elected 12 congressional terms ago.

And the big election issue: taxes.

“Absolutely,” said Jay Webber, the Republican congressional candidate in the district, taxes are the number one issue for constituents. “And there's nothing that's a close second. New Jersey is the most overtaxed state in the union,” he told ABC News.

“It's going to be a huge part of the election,” agreed his opponent, Democrat Mikie Sherrill, in a separate interview.

But while they agree the tax burden needs to be reduced, each candidate insists their opponent is going to bring tax hikes.

“People desperately want relief,” said Webber, a conservative state assemblyman and attorney who grew up in the district and is raising his family of nine here.

“And that's why taxes is the number one issue for me. I want to cut them. My opponent doesn't. And it's a major difference between the two of us,” he said.

But his opponent says she does indeed want to cut taxes; the new bill just isn’t the best way for New Jersey, which she says already gives so much to a Washington. Sherrill, too, has made tax cuts the central issue of her campaign. The difference is that Webber supports the GOP tax measure while Sherrill opposes it, although both say they’d try to eliminate the SALT cap.

“I think voters just know that this tax plan has been bad for them. They've gone to their accountants. They know how much money they're going to be able to deduct come January,” she said. The average SALT deduction in the district is around $20,000 — double what's allowed under the new SALT cap.

“You can't pull the wool over their eyes and act like this is a great tax plan for New Jersey,” Sherrill said.

But Webber, who held a campaign event with the bill's chief proponent, House Speaker Paul Ryan, in the district on Wednesday, calls Sherrill’s outlook “negative.”

“We're going to continue to be clear that the tax bill that Congress passed last year is a net tax cut for the average family of four in this district, to the tune of $6,000,” said Webber, citing statistics from the Republican-run House Ways and Means Committee.

“I never put my finger in the wind and say, ‘What do the polls say?’ and then go figure out my platform,” Weber said, responding to polling that shows the GOP plan might be problematic.

In the affluent town of Mountain Lakes, the running joke among parents is that when students reach the ninth grade, families move next door to Boonton Township, where property taxes are lower but students can still attend Mountain Lakes High School.

Mary Bovich, a resident of Essex County, where state taxes are the highest in the district, said she pays $27,000 in property taxes in her hometown of Verona.

“They’re horrible. They’re absolutely out of control,” she said. “I’m only going to be able to deduct $10,000. Am I mad about that? Yes, I am.”

But Bovich, a staunch Webber supporter who voted for Trump in the 2016 presidential election, still sides with her party. Bovich doesn’t think the smaller SALT deductions are the problem.

“This is how I look at it. The deduction is medication. The cancer is high taxes. Yeah, I’m sorry that I can’t take the full medication, but the problem is the high taxes,” she said, standing outside the third and final debate between Webber and Sherrill in Wayne, New Jersey.

“Municipal, county and state taxes need to be reduced,” Bovich said.

There's no question, though, that for voters from either party, especially in a district where the median income is over $108,000 -- well above what it is nationally, taxes are the motivating issue.

“Are people vulnerable to taxation messages? Yes,” said Dana Pogorzelski, a mother of three and retired consultant from Mountain Lakes who started an action group that supports Sherrill.

“I think it’s a two-part problem,” she said. “Part one is everybody’s getting a tax cut and we’re not, and then, in general, New Jersey is already a net-giver relative to other states. So, it just seems insane that New Jersey needs to give even more,” she said. New Jersey residents paid a record average of $8,690 in property taxes in 2017, according to state data.

But Webber, who's been consistently out-fundraised by his opponent despite the district's Republican history, is prepared to stay the course and stick by his party.

“Some people like it, some people don't," he said. "I think you'd find that a lot of Democrats don't like it because it's a partisan issue, because Donald Trump did it, and a lot of Republicans do like it because it's a Republican bill."